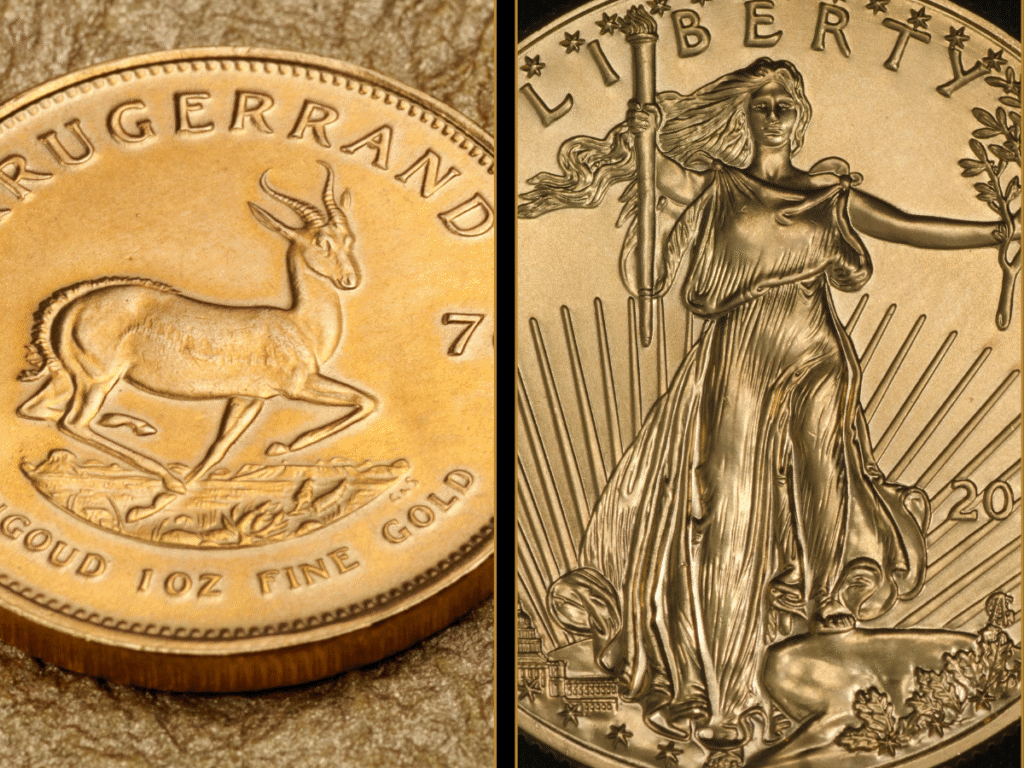

Investing in physical gold often means choosing between the most trusted bullion coins. Two of the top contenders are Krugerrands and American Gold Eagles. Each coin offers unique advantages in terms of liquidity, premium over spot, government backing, and long-term preservation of wealth. In this article, Westlake Gold compares Krugerrands vs. American Gold Eagles to help you decide which is best for your portfolio.

Why Gold Coins Are a Smart Investment

Before comparing specific coins, let’s review why investors choose gold coins:

- Hedge against inflation and economic uncertainty

- Diversification in your investment portfolio

- Tangible asset with intrinsic value

- High liquidity and global recognition

When you buy gold coins, you also want coins with strong resale value, low premium over spot price, and reputable origins. Keywords buyers search often include best gold coins to invest in, gold bullion coins, American Gold Eagle value, Krugerrand price, and which gold coin is better.

Ready to sell your gold coin investment? Contact Westlake Gold today for top dollar offers.

Key Features of Krugerrands

Purity and Composition

Krugerrands contain 22-karat gold (91.67% pure gold). The copper in their alloy makes them durable and resistant to scratching.

History and Recognition

Introduced in 1967 by the South African Mint, Krugerrands were the first modern bullion coins and are still among the most widely recognized gold coins worldwide.

Premium over Spot Price

Krugerrands generally have a lower premium over spot compared to many other coins, meaning investors get more gold per dollar spent.

Liquidity

Krugerrands are accepted by dealers around the world, making them highly liquid and easy to sell.

Color and Appearance

Their copper content gives them a warm, reddish tone that some collectors find appealing.

Tax Considerations

Krugerrands are not eligible for inclusion in U.S. Precious Metals IRAs, which is important to consider for retirement planning.

Key Features of American Gold Eagles

Purity & Alloy

American Gold Eagles are also 22-karat gold but use a mix of copper and silver for added strength and a slightly brighter finish.

Government Backing & Legitimacy

Minted by the U.S. Mint, American Gold Eagles carry the full backing of the U.S. government, which boosts confidence and resale value among U.S. buyers.

Premium Over Spot Price

American Gold Eagles typically sell at a higher premium due to demand and minting costs.

IRA Eligibility & Tax Benefits

These coins are eligible for Precious Metals IRAs, making them attractive for tax-advantaged retirement investing.

Recognition and Demand

They enjoy strong domestic demand and are one of the easiest coins to resell in the United States.

Design & Options

American Gold Eagles are available in multiple fractional sizes (1 oz, ½ oz, ¼ oz, 1/10 oz), giving investors more flexibility.

Direct Comparison: Krugerrand vs American Gold Eagle

| Feature | Krugerrand | American Gold Eagle |

|---|---|---|

| Purity | 91.67% (22K) | 91.67% (22K) |

| Alloy Components | Copper (reddish tone) | Copper + silver (brighter finish) |

| Premium Above Spot | Usually lower | Typically higher |

| Global Liquidity | Strong | Very strong, especially in the U.S. |

| IRA Eligibility | Not eligible | Eligible |

| Fractional Size Options | Mostly full ounces | Multiple fractional sizes available |

| Resale in U.S. | Good | Excellent |

Which Gold Coin Is Best Depending on Your Goals

- Lowest Cost Entry & Minimal Premium – Choose Krugerrands if you want to maximize gold per dollar spent.

- Tax Advantages and IRA Eligibility – American Gold Eagles are the better option for retirement investing.

- Selling in the U.S. – Eagles often have stronger resale demand and dealer preference.

- Global Diversification – Krugerrands are recognized worldwide, making them ideal for international investors.

- Smaller Budgets – Eagles provide fractional coin options for those looking to buy gradually.

Ready to sell your gold coins? Contact Westlake Gold today.

Potential Downsides to Consider

Premium spikes can occur during high demand periods, even for Krugerrands. Counterfeit risks mean you should always buy from a trusted dealer like Westlake Gold. Storage and insurance costs can impact overall returns, and taxes or import duties may apply depending on where you sell.

Verdict: Which Gold Coin Wins?

For many U.S. investors, American Gold Eagles provide trust, flexibility, and tax benefits that make them a top choice. But if your goal is to acquire gold at the lowest possible cost or you plan to sell internationally, Krugerrands may be the better buy.

At Westlake Gold, we believe the right choice depends on your goals, budget, and where you plan to resell. Whether you choose Krugerrands or American Gold Eagles, you’ll be adding a powerful hedge and a timeless store of value to your portfolio.

Image courtesy of Canva